How Professional Athletes Can Check Their Business Advisors' Professional Backgrounds

- Chris McCauley, CPA, Esq.

- Jun 30, 2016

- 10 min read

When those checks first start being deposited into your bank account, it can be an exciting, but also anxiety-inducing, time.

As you may have already found out, trying to find somewhere to put your money where it will be safe, grow in value and pay you a stream of income for years to come can be extremely difficult.

For some professional athletes, the initial location for investing money will be an employer's 401(k), which is a great start, but what's next after that?

Investment advisers, financial advisors, brokers and CPAs are just some of the business professionals who can help you find answers to that question. There's just a slight problem. When you don't have a background in high finance, how can you find out which advisors are more likely to be reliable, trustworthy and qualified when your money is on the line?

You're in luck. This post will help you find out the critical pieces of information you'll need to have when filtering out opportunists, liars and fraudsters from business professionals who are subject to strict ethical guidelines.

Agent Recommendations

To get started on your search for business advisors, you might be tempted to ask your agent for recommendations on business advisors. Any agent worth his or her commission check certainly should have recommendations on money managers, financial advisors and CPAs, right? At the same time, if you haven't been pleased with your current agent, you might be reluctant to even ask for suggestions.

If you do decide to rely on your agent, be sure to casually ask if he or she is getting a referral fee under the table. Certain professions, such as attorneys, prohibit compensation for direct referrals, and some professions aren't guided by such ethical principles. For your purposes, you'll want to determine if you're getting this referral because your agent is being compensated with cash, receiving some other benefit or genuinely looking out for you.

Teammate, Family and Friend Recommendations

Some other great resources for advisor recommendations are teammates, family members and friends. Even recommendations through your own network require some due diligence on your part to make sure whoever you hire has a clean background and is properly licensed. So while you may trust these people close to you, their recommended advisors might still have a history worth evaluating.

Internet Search

Lastly, searching the Internet is always an option, but as you know, the Internet will turn up just about anything. Plus, there are plenty of ways for people to manipulate information to put themselves in a favorable light.

If you choose to use the Internet to find a business advisor on your own, please take the time to thoroughly investigate him or her before giving your business. You might even want to set up a face-to-face meeting to get a feel. One other trick is to check out their social media accounts. If this advisor has some loyal followers who are also clients, simply ask them about working with that advisor. Let them know you're interested in hiring business advisor X, and you would like to know about their experiences.

Checking Out Your Business Advisor's Backgrounds

Regardless of how you find your business advisors, you always want to look into their backgrounds, especially if they're throwing around professional designations, such as one or several of the following:

Certified Public Accountant (CPA)

Attorney (Esq.)

Certified Financial Planner (CFP)

Chartered Financial Analyst (CFA)

Broker and Dealer (legal term used by both federal and state securities commissions)

Investment Adviser (legal term used by both federal and state securities commissions)

Insurance Agent/Company

Real Estate Agent, Broker and REALTOR®

While there are plenty of professional designations (here's a comprehensive list of more of them), this list compromises the most common.

Advisors of all types know professional designations help them sell their professional services, and those credentials can also provide a competitive advantage, which is why some people lie about having them - to get your business.

Next time someone claims to have one of these professional designations, check them against the one or several of the websites provided below.

Certified Public Accountant

All CPAs are required to be registered with a state board of accountancy, and finding out if someone who claims to be a CPA is, in fact, a CPA is quite simple to do.

Before you can verify someone's claim of being a CPA, however, you'll need to find out in which state(s) is he/she registered. Generally, it should be the state where he/she is providing public accounting services, but for various reasons, this is not always the case. Simply ask where his/her principal place of business is located, and the answer to that question is where you can start your search.

Search Example: For me, my principal place of business is in Washington, but my original CPA license (which I'm using to be licensed to practice in different states) is in North Carolina. I should show up in both Washington's and North Carolina's CPA records (see search results below). As you'll note in the search results provided below, you'll be able to determine the status of the licensee and when it was issued.

One thing to note is that only active licensees are required to meet certain educational requirements. If you find that someone is inactive, retired, suspended, etc., it means that person once held a license, but is no longer required to meet educational requirements, which could mean they aren't on top of the latest developments in the accounting world.

Search Result for Washington:

Search Result for North Carolina:

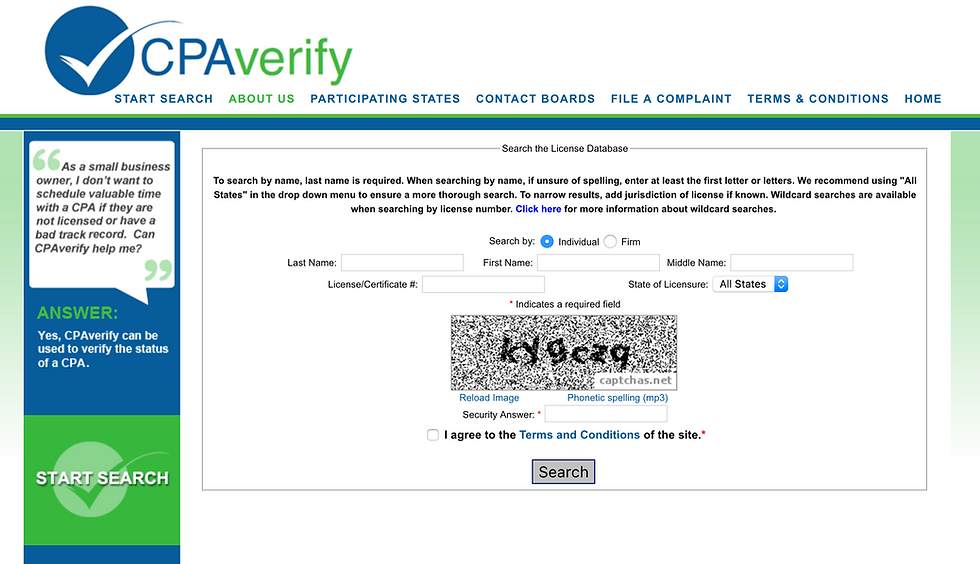

Not interested in searching multiple states? CPAverify is an aggregator of licensed CPA professionals. Instead of searching individual states, you can simply search on CPAverify. To do so, when you're on the home page, click "Start Search" in the top left corner to begin your search.

Bar Admission (Attorney)

Similar to CPAs, attorneys also have to be admitted to a state bar in order to be able to practice law in that state. (There are very limited exceptions to this, but they are mostly related to in-house counsel and litigators.) In order to keep this license active, attorneys have to regularly take continuing education classes.

To get started with your search, simply find out where the person is claiming to be a licensed attorney, locate that state's bar website and run a search. For an interactive map of state and local bars, click the image below or click here.

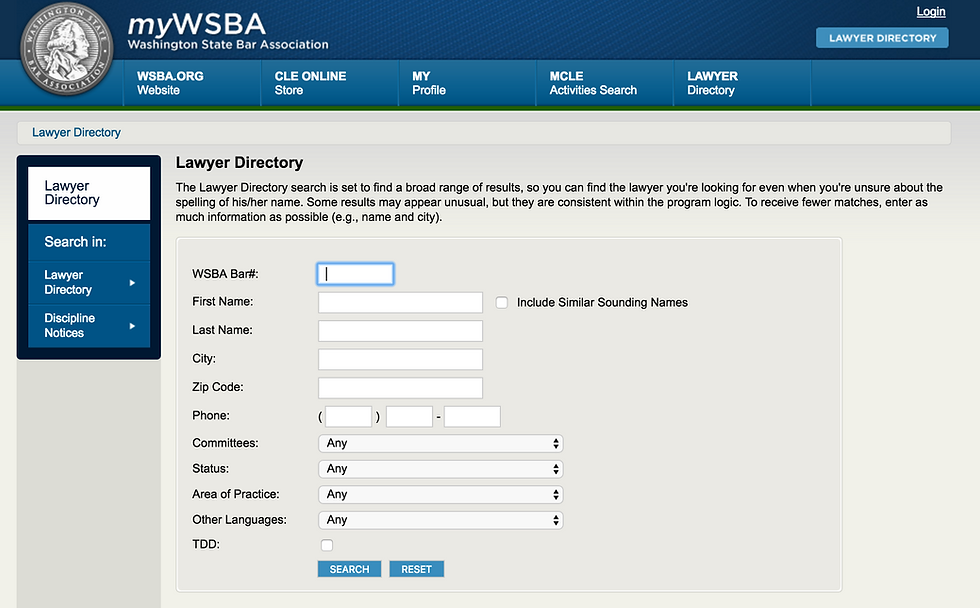

Search Example: For me, I'm licensed to practice law in Washington and Alabama. I've provided an example of the Washington State Bar Association's search feature below:

Search Result for Washington:

Certified Financial Planner

To find out if someone is a Certified Financial Planner® (CFP), you can search for him or her by clicking the image below or by clicking here:

Chartered Financial Analyst

The Chartered Financial Analyst (CFA) is one of the most regarded designations for an investment professional, so you may find that your broker and/or investment adviser is one, or claims to be one, to get your business.

Most investors prefer to see their investment professionals with a CFA designation because it generally means (or at least gives the impression) the charterholder has put significant time into his or her skills and career. Nevertheless, the CFA does not mean someone is great at picking investments.

There are a few limitations with checking the status of CFAs. Assuming someone is a charterholder, he or she should show up in your search, but the information is limited. To specifically find out the professional conduct history of a CFA, you'll have to write the CFA Institute. For more information on conduct history, click the image below or click here to be taken to CFA Institute Professional Conduct History Requests website.

To find out if your investment professional is a charterholder, you can click on the image below or click here.

Brokers

If you've ever given someone else the authority to execute a securities transaction on your behalf you've worked with a broker. Depending on your appetite for trading and picking stocks for yourself, you might have used a discount broker, such as E*Trade, TDAmeritrade or Scottrade, or a traditional broker who picked stocks for you and purchased them on your behalf.

Under either scenario, the broker is required to be registered with the Financial Industry Regulatory Authority, or FINRA. You can check if the broker has met this registration requirement by using BrokerCheck by FINRA.

BrokerCheck will tell you a broker's employment history, record of licenses, regulatory actions and professional conduct and complaints, but it will not tell you who is a good broker or how well your money will be managed.

Whenever someone offers you a security, simply ask them if they are licensed with the Securities and Exchange Commission, FINRA and/or a state securities regulator. If he or she said yes, that person should be on file with one of these governmental agencies. Run your search.

Investment Adviser

An investment adviser, which is a legal term (and purposely spelled with an "e") used by federal and state securities commissions, is an individual or company who is paid for providing advice about securities to their clients. Investment advisers must register with federal and/or state securities commissions before:

providing advice,

making recommendations,

issuing reports or

furnishing analyses

on securities, either directly or through publications, for compensation.

Other names for investment advisers include asset managers, investment managers and wealth managers. Regardless of the name, if a business professional or company is providing any of the above services, he or she should be registered with the Securities and Exchange Commission and/or state securities commission. (There are some exceptions to registration provided to attorneys and CPAs, but only if those services described above are only provided as a consequence of legal or accounting services.)

Generally, investment advisers who manage $110 million or more in client assets are regulated by the SEC. Investment advisers managing less are regulated by the state in which the investment adviser has its principal place of business. To find this out, simply ask your investment adviser where he/she is registered.

Understanding the differences between an investment adviser and broker can be difficult. Fortunately, you can quickly get an answer by asking your advisor. Using this answer, you'll be able to determine what duties you're owed as a client.

One of the main differences between an investment adviser and broker is that the investment adviser has a fiduciary duty with their clients and are required to look after their clients. This means investment advisers are obligated to act in your best interest and provide you investment advice that is in your best interest. Investment advisers are prohibited from engaging in activities in conflict with your interest. This fiduciary duty is not the same with brokers. Brokers simply have to have a reasonable belief that a recommendation is suitable. This recommendation may not always be in the client's best interest.

There are a lot of strict requirements that come with being registered investment adviser. Acting as an investment adviser without being registered is a violation of both state and federal laws. So when it comes to working with investment advisers, either the individual or company is:

registered and listed in the Investment Adviser Public Disclosure and/or BrokerCheck databases, or

in violation of federal and state securities laws.

So when you do your search, if they're acting as an investment adviser and is not registered with the state and/or the Securities and Exchange Commission, don't hire him/her.

To get started in your search, click here to visit the Investment Adviser Public Disclosure website or click the image below.

Insurance Agent or Company

Insurance agents sell a variety of insurance products and policies for health, life and property. When working with insurance agents, the last thing you want to have happen is to realize a loss, file a claim and find out the insurer is insolvent, unlicensed and unable to cover you for your losses.

To help protect consumers from this exact situation, every state has an insurance commission that regulates insurance agents and companies. These commissions are responsible for issuing licenses to insurance agents and companies, making sure insurers and their agents are following rules and insured parties get the coverage they signed up with through their policies.

Before you can begin your search on an insurance agent or company, you'll need find your state's insurance commission. Click the image below or click here to be taken to an interactive map of insurance commissions. Select the state where you're trying to obtain insurance to be taken to that state's insurance commission.

Example: I've provided the insurance agent/company search engine for the State of Washington.

Real Estate Agent, Broker and REALTOR®

A new home might be one of the first purchases you make, and it might also be the most expensive purchase you'll ever make. As a result, you'll want someone who is licensed and knows what he/she doing when handling your real property matters. While this is in no way an in-depth discussion on purchasing real property, here are a few terms to keep in mind when working with a real estate agents:

Real estate agent: Only someone who has earned a real estate license can be called a real estate agent. Licensing requirements are set by individual states. As a result, you'll need to check the appropriate licensing body in each applicable state.

REALTOR®: A REALTOR® is also a real estate agent but with a membership in the National Association of REALTORS®. Being a member of this association means that he or she must complete additional requirements beyond those required by the state and uphold the standards of the association and its code of ethics.

Real estate broker: A person who has taken education beyond the real estate agent level as required by state laws and has passed a broker’s license exam.

All real estate agents are required to be licensed by the state in which he/she is acting on behalf of a buyer or seller. Some real estate agents take the extra step to become a REALTOR®, which is a professional designation created by the National Association of REALTORS® and requires recipients of the REALTOR® designation to meet higher standards.

To search for real estate agents and brokers, you'll have to find your state's specific real estate licensing website. As an example, I've provided the search database for real estate professionals in Washington. When evaluating your agent, you'll need to check the state where he/she is acting as an agent.

To search for REALTORS®, you can use the official REALTOR® website. Click the image below or click here to get started.

If you choose to work with a REALTOR® and search for him/her on the REALTOR® website, I suggest searching the state's licensing website as well to make sure the person hasn't lost his/her license at the state level and the license information has not yet been updated in the REALTORS® database.

Homework:

These are just a handful of websites that can be use to verify information. Other options include checking UCC filings for any evidence of loans they may have taken out, reviewing court records and police records.

Do you know any other websites that might help professional athletes research their business advisors before hiring them? Please share in the comments below.

Chris McCauley, CPA, Esq. is the founder of McCauley Investment Risk & Legal Consulting PLLC, a Seattle-based law firm dedicated to helping professional athletes guard their earnings and investments. Chris is an attorney licensed to practice in Alabama and Washington and a CPA licensed to practice in Washington and North Carolina.

Comments