Fraud and Professional Athletes: Mark Sanchez, Jake Peavy and Roy Oswalt Fall Victim to $30 Million

- Chris McCauley, CPA, Esq.

- Jun 22, 2016

- 7 min read

Earlier this week, the Securities and Exchange Commission (SEC) unsealed a securities fraud case that involved at least three high profile professional athletes who fell victim to a more than $30,000,000 investment scheme. Although the SEC Complaint kept the names anonymous, a report by Bloomberg revealed those high-profile athletes to be:

Denver Broncos QB Mark Sanchez,

Retired pitcher, NLCS MVP (2005) and 3x All-Star Roy Oswalt and

San Francisco Giants Pitcher, 3x All-Star and NL Cy Young Award winner Jake Peavy.

"Mark Sanchez" by Keith Allison is licensed under CC BY-SA 2.0.

The SEC Complaint states the fraud is in excess of $33,000,000 (with up to 77 clients involved), but of that amount, $30,000,000 belonged to Sanchez, Peavy and Oswalt combined. Based on the information provided in the SEC Complaint and the Bloomberg report that identifies the individuals, the breakdown of the client funds unlawfully transferred to The Ticket Reserve Inc. (Ticket Reserve) and the respective "finder's fees" earned by one of the Defendants that are at the heart of this fraud can be found below.

What happened?

According to the SEC, Ticket Reserve, Ash Narayan (majority shareholder and a director of Ticket Reserve), Richard Harmon (CEO of Ticket Reserve) and John Kaptrosky (COO of Ticket Reserve) orchestrated a Ponzi Scheme to hide approximately $2,000,000 in "finder's fees" paid to Narayan for raising funds through his role at RGT Capital Management, Ltd. (RGT Capital), an SEC-registered investment adviser.

After trusting Narayan, Sanchez, Peavy and Oswalt transferred funds to Narayan in his capacity as Managing Director at RGT Capital with strict instructions for conservative investments only. Narayan then transferred those approximately $30,000,000 of those funds into Ticket Reserve (the company where Narayan is the majority shareholder and director) without their knowledge and/or consent.

What is Ticket Reserve?

(Archived Homepage of The Ticket Reserve Inc. Source: http://archive.org/web)

Ticket Reserve was founded back in 2002 and operated out of Illinois. According to the SEC, Ticket Reserve was an online business that allowed fans to reserve face-value tickets to high-demand sporting events whose teams are yet to be determined, such as a college bowl game or a professional sport playoff game. Fans pay a fee for the right to reserve these tickets. The business model consisted of leveraging the value of anticipation.

Unfortunately, Ticket Reserve appeared to be a major bust. At least from 2012 to 2015, Ticket Reserve suffered operating losses in the millions with accompanying operating cash flows (that is, real cash going out the door) also amounting in the millions for at least 2012 and 2013 fiscal years. (Operating cash for 2014 and 2015 was not available in the SEC Complaint.) In order to keep the Ticket Reserve afloat, Narayan allegedly went out to raise funds on behalf of Ticket Reserve while using the reputation of RGT Capital.

How did the scheme work?

According to the SEC Complaint, the scheme played out as follows:

As an investment adviser at RGT Capital, Narayan gained clients' trust by claiming a shared Christian faith, an interest in charities and a CPA license. (Narayan was not, and has not been, a CPA.)

After clients provided Narayan with funds, he then transferred those client funds out RGT Capital to Ticket Reserve without their consent and/or knowledge and in violation of RGT Capital's policies.

In concert with the Ticket Reserve's CEO and COO, Narayan received undisclosed finder’s fees from Ticket Reserve for the new investment proceeds but disguised them as “director’s fees” or “loans.”

Narayan then drafted/executed fake promissory notes between Ticket Reserve and Narayan to make the finder’s fees appear as "loans" that would be repaid by Narayan.

To cap off the scheme, the Defendants took on new investment funds in order to pay back other investors - the typical Ponzi Scheme.

Today, Narayan is attempting to make payments on the "loans," which the SEC believes is a ruse to further cover the fraud.

Throughout the scheme, the SEC claims that Narayan, in concert with Ticket Reserve, Harmon and Kaptrosky:

Failed to disclose that he received almost $2 million in finder’s fees;

Failed to disclose that he was a member of Ticket Reserve’s Board of Directors and a major shareholder (owning over 3,000,000 in shares);

Failed to disclosed that Ticket Reserve was a financially distressed company and a high-risk investment;

Failed to disclose that the Ticket Reserve investments violated RGT’s policies;

Violated his fiduciary duties to his clients; and

Regularly transferred his clients’ funds to Ticket Reserve without their knowledge or consent, often using forged or unauthorized signatures.

All of which violate several securities anti-fraud provisions.

What can you take away from this?

There are a lot of complexities in this particular Ticket Reserve investment scheme, and when one party allegedly forges signatures and/or falsifies documents (such as in this Ticket Reserve case), discovering fraud can become more difficult.

In some cases, however, there will be red flags that can help you discover that something is not right about your investment. For the Ticket Reserve case, identifying Narayan was not actually a CPA might have been all that was necessary to mitigate the total amount of money involved in this scheme.

Check Your Advisor's Professional Background

The SEC and state securities commission take the regulation of securities very seriously, which is why they require parties that manage the finances of others, such as investment advisers and brokers, to be registered.

In addition to investment professionals, you can find out the truth about whether someone is a licensed CPA or attorney quite easily. (I've provided a listed of key websites that'll help you get started.)

Now, if your search reveals someone is not registered as claimed, simply follow up with them. It may even help to begin the conversation by saying, "my attorney/CPA tried to find your registration information online but they couldn't. Will you send me a link so I can forward it to him or her?" If there's just a mix up in states, there's no issue, but if it turns out he/she is lying, you might want to reconsider handing over your money.

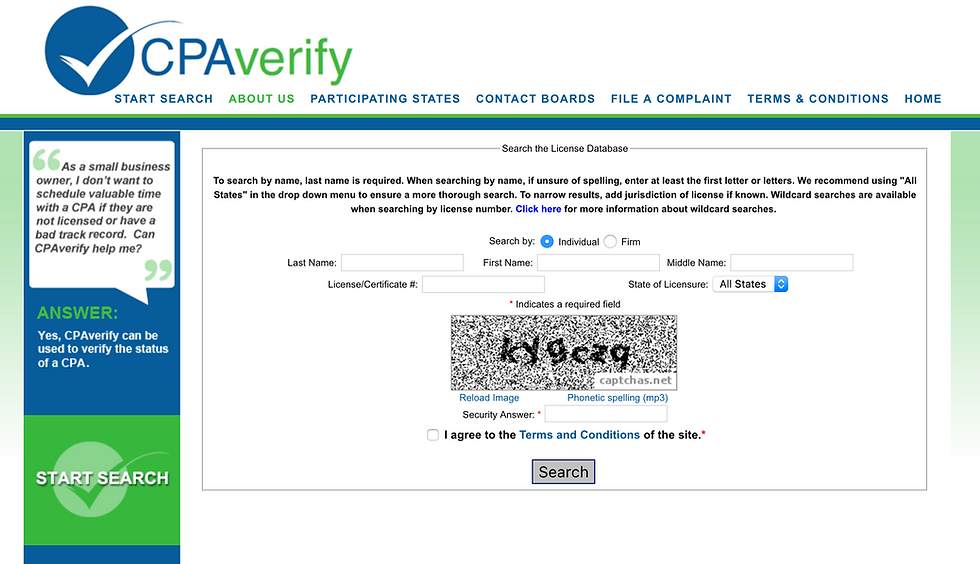

Certified Public Accountant

All CPAs are required to be registered with a state board of accountancy, and finding out whether someone who claims to be a CPA is, in fact, a CPA is quite simple to do.

Before you can search someone's claim of being a CPA, however, you'll need to find out in which state(s) is he/she registered. Generally, it should be the state in which he/she is providing public accounting services, but for various reasons, this is not always the case.

Example: As a CPA, I'm registered in both Washington and North Carolina. Here's an example of the search fields for the Washington State Board of Accountancy and the results of a search on my name.

Search Result:

[Edit: June 23, 2016]

CPAverify is an aggregator of licensed CPA professionals. Instead of searching individual states, you can simply search on CPAverify. When you're on the home page, click "Start Search" in the top left corner to begin your search.

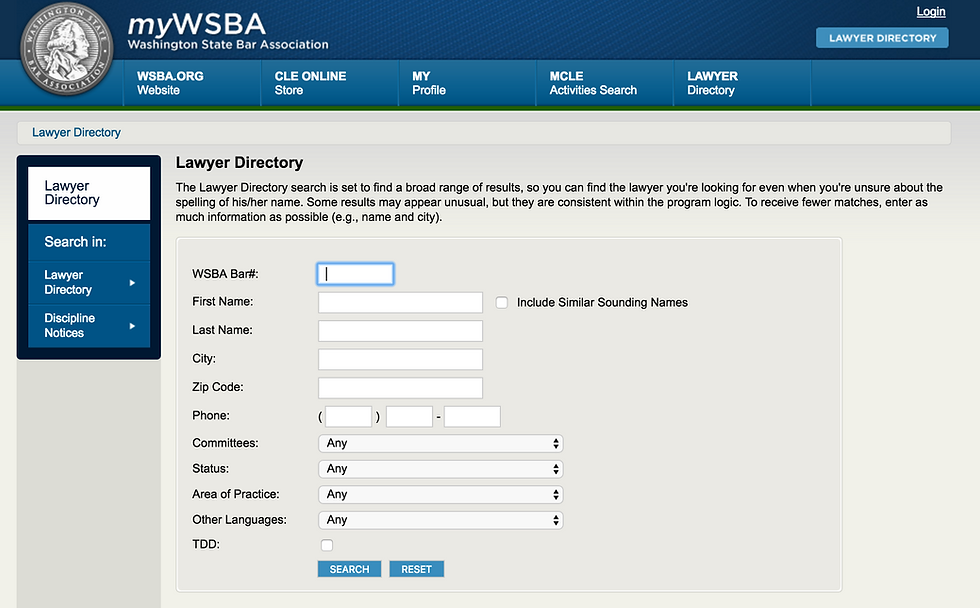

Bar Admission (Attorney)

Similar to CPAs, attorneys also have to be admitted to a state bar in order to be able to practice law in that state. (There are very limited exceptions to this, but they are mostly related to in-house counsel and litigators.) Simply find out where the person is claiming to be a licensed attorney, locate that state's bar website and run a search.

Example: For me, I'm licensed to practice law in Washington and Alabama. I've provided an example of the Washington State Bar Association's search feature below:

Search Results

Certified Financial Planner

To find out if someone is a Certified Financial Planner (CFP), you can search for him or her by clicking the image below or by clicking here:

Chartered Financial Analyst

The Chartered Financial Analyst (CFA) is one of the most regarded designations for an investment professional, so you may find that your broker and/or investment adviser is one, or claims to be one to get your business.

Investors particularly prefer to see their investment professionals with a CFA designation because it generally means (or at least gives the impression) the charterholder has put significant time into his or her skills and career. Nevertheless, the CFA does not mean someone is great at picking investments.

To find out if your investment professional is a true charterholder, you can click on the image below or here.

Broker and Dealer

If you find yourself picking up the phone or sending off an email to someone, saying "buy X amount of shares of ABC Company," that person and the firm where he or she is employed should be registered with Financial Industry Regulatory Authority (FINRA).

You can find out if he or she is registered, his or her experience, any disciplinary actions and the limitations on brokerage services by using BrokerCheck.

Investment Adviser

Investment advisers, which is a technical term, must register with either the SEC and/or state securities commissions. The SEC requires anyone who is engaged in the business of providing advice, making recommendations, issuing report or furnishing analyses on securities, either directly or through publications, for compensation to register with the them. Other names for investment advisers include asset manager, investment manager and wealth manager.

To help investors, the SEC offers a search to determine whether your "investment adviser" is registered. You can try this out by clicking the image below or here.

Disclaimer: The U.S. Securities and Exchange Commission alleges the violations stated above in this blog. Defendants may not be found liable for any of the allegations in this SEC complaint. Source: U.S. SEC v. Ash Narayan, The Ticket Reserve Inc. a/k/a Forward Market Media, Inc., Richard M. Harmon, and John A. Kaptrosky, No.16-CV-01417 (N.D. Tex. May 24, 2016) [SEC Complaint PDF]

If you're an investor, what other methods do you use to research your investment professionals? Have you ever uncovered anything? Please share in the comments.

Chris McCauley, CPA, Esq. is the founder of McCauley Investment Risk & Legal Consulting PLLC, a Seattle-based law firm dedicated to helping professional athletes guard their earnings and investments. Chris is an attorney licensed to practice in Alabama and Washington and a CPA licensed to practice in Washington and North Carolina.

Comments